Looking at Options to Cover Inpatient Mental Health Treatment

Those who need professional mental health services sometimes fail to pursue the inpatient treatment they need because they fear the cost. They wonder how to pay for residential mental health treatment, now knowing that their health insurance coverage will pick up much of the cost for therapy sessions and more.

Catalina Behavioral Health works with the best-known insurance companies to ensure our clients receive professional treatment for their mental health conditions.

Severe mental health disorders will greatly benefit from our inpatient treatment options. This page will help you discover how to pay for the therapeutic services you can receive at Catalina.

Get Accredited Treatment Programs at Catalina

Why Does Insurance Cover Residential Treatment Programs?

The misunderstanding that insurance plans don’t cover residential treatment dates back to the days before the Affordable Care Act was passed into law.

Before the ACA, or Obamacare became law, group and private health insurance plans often had unfair rules, harming people with mental health challenges.

Mental Health Services Were Often Excluded Before the ACA

In 2008, things started to improve. The Addiction Equity Act passed, with the goal of stopping insurance companies from denying substance use disorder treatment services. While that was helpful for those who sought substance abuse treatment, it still had many loopholes. It also excluded all other mental health issues.

The ACA mandated mental health parity, forcing every insurance policy listed on the Health Insurance Marketplace to provide equal coverage for mental health issues. They would no longer be allowed to deny mental health benefits but had to consider them with the same importance as physical health conditions.

Tactics Group and Private Insurance Companies Used to Block Mental Health Services

Until the ACA stopped many insurance companies from doing so, they used some of these tactics to deny mental health insurance coverage to those with a mental illness were:

- Deeming a common mental health issue, like depression, a pre-existing condition to deny benefits.

- Making it difficult or a treatment facility to become in-network on the plan.

- Increasing the medical necessity criteria to almost impossible standards.

- Imposing unreasonable coverage limits and increasing out-of-pocket maximums, putting residential care out of reach.

Today, insurance companies that don’t comply with laws mandating mental health care cannot add their plans to the Health Insurance Marketplace. The ACA is both a law helping people who require residential mental health treatment and an enforcement measure to keep powerful insurance companies in compliance.

Applying Insurance Coverage to Residential Treatment Costs

What services at a residential treatment facility are covered by your insurance provider? As long as a healthcare provider shows that the treatment plan is medically necessary, they cover the following psychological/medical services:

- Inpatient care in a supportive environment

- Outpatient services, including partial hospitalization or IOPs for mental health

- Developing effective coping strategies with licensed healthcare professionals

- Individual and group therapy and counseling

- Medical detoxification

- Medication management

- Medication-assisted treatment

- Integrated services for complete physical and mental health

Affording the costs of mental health treatment is easier now than ever because insurance plans must provide coverage for residential/outpatient services. Which level of care they will cover depends on an individual assessment by a doctor.

Verify Your Insurance Coverage for Free – Call Now!

Our Admissions Team Will Guide the Insurance Process for You

The process of contacting the insurer to learn more details about your insurance coverage is a frequent first step to seeking treatment. The thought of calling a stranger to explain their specific needs by phone can feel overwhelming for people trying to find help affordable mental health treatment.

Our admissions team are experts at guiding this process and can help with making any necessary phone calls for you (or your loved one, if you’re reading this page to help someone else).

We obtain all necessary pre-authorizations for your mental health care or addiction treatment before your admission. You’ll know any out-of-pocket treatment costs before your arrive, allowing you to immerse yourself into the therapeutic process.

When you call to find out if your insurance provider will cover you at our residential treatment facility, you will only need to provide information to us. We take it from there.

Study Finds Some Companies Still Deny Coverage for Mental Health/Addiction Treatment

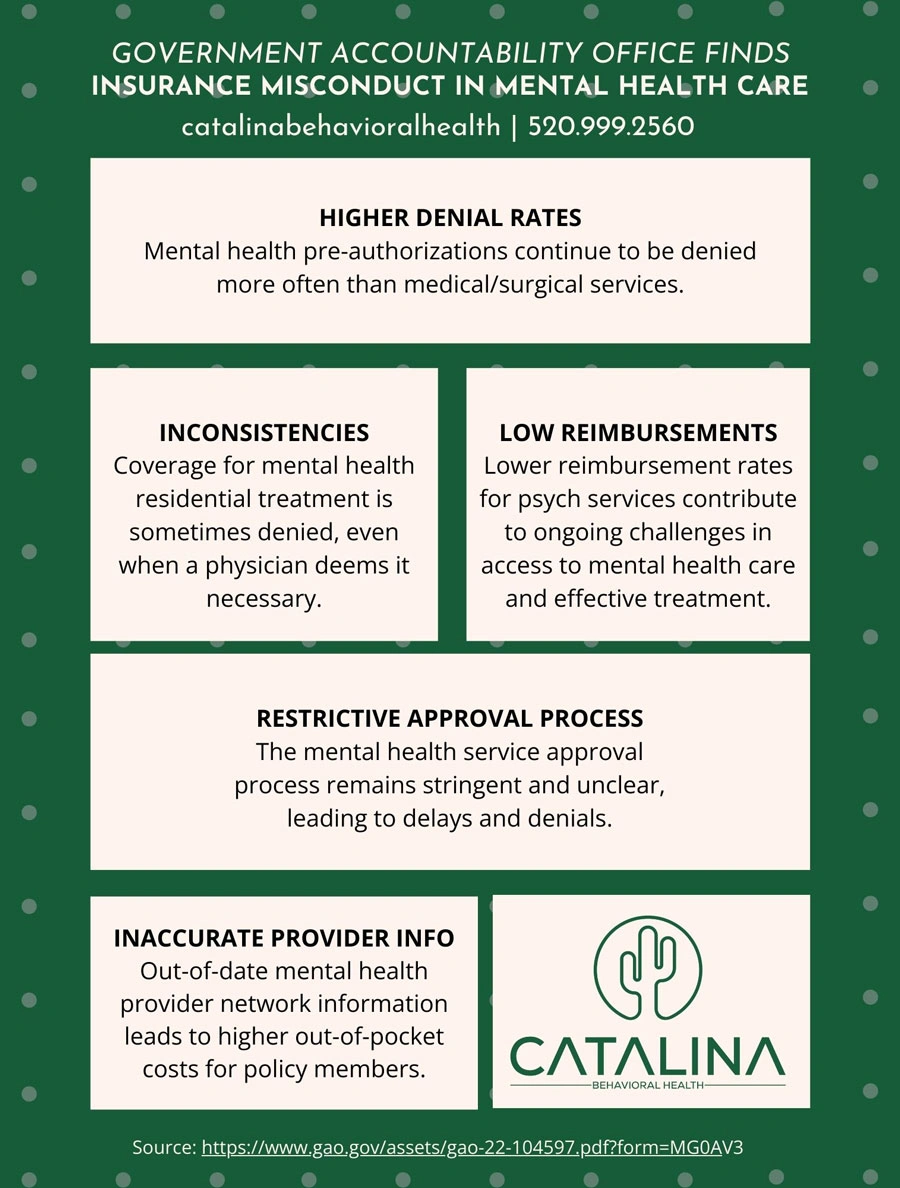

The United States Government Accountability Office (GAO) studied the behaviors of insurance providers in 2022. They found that requests for pre-authorization for treating mental health disorders is denied more often than care for medical/surgical services.

In other words, insurers are still playing games with coverage. They’re more likely to authorize care for a physical health or surgical procedure than for a mental health treatment program.

Further, they note that some private health insurance and Medicaid systems have also received numerous complaints for denying financial assistance for residential treatment, even when a mental healthcare provider deems it necessary.

This GAO report makes it perfectly clear why you should call Catalina for help with your insurance coverage.

Calling Catalina for Help with Insurance Coverage for Residential Treatment

What will you need when you call our admissions department? You’ll provide our admissions team nothing but your current contact information and a few pieces of information from your insurance policy card. Many residential treatment centers do not offer this service, but we believe it proves our commitment to providing you with top-notch care.

Besides that, we will ask you a few questions about your current needs. These questions help us find the right level of care and can help lower mental health cost for you.

We may ask these questions to qualify your residential treatment:

- Have you tried other outpatient or residential treatment centers previously?

- Why do you need residential treatment?

- Has past counseling provided by employee assistance programs through your company’s human resources department been ineffective?

- Are you considering harming yourself or others?

- What mental health crises have you experienced?

Your answers to these questions help us explain the severity of your challenges to the insurer. They may feel invasive at first. Rest assured that they are key to obtaining maximum coverage or mental health treatment. Our mental health professionals are bound by HIPAA and your discussion is confidential.

What if I’m Denied Coverage for Residential Treatment?

Being denied coverage for mental health treatment centers can feel like a real setback. We can guide you through the appeal process.

Appealing usually starts with escalating the request internally in the insurance provider’s system. If they still won’t budge, there’s often a way to request intervention by an independent review organization.

Seeking Financial Assistance if Denied or for Self-Pay Clients

In the event of a denial of full coverage, many start to explore alternative financing options:

- Applying funds from Flexible Spending Accounts

- Personal loans

- Attending residential care at Catalina followed by stepdown outpatient support at local community mental health centers with flexible payment plans and sliding scale fees.

- Checking with a financial planning expert about borrowing against investments

These may not be ideal, but for someone who needs the intensive care offered by residential treatment centers, they are a last option.

Up To 100% of Rehab Costs Covered By Insurance

Get Proven Recovery Support with Residential Treatment at Catalina

It’s hard to find the courage to reach out for mental, behavioral, and substance abuse treatment. For those seeking residential treatment programs. It’s a cry for help that we are glad to answer.

If you’re ready to have our help getting your residential treatment pre-authorized, call Catalina right now. We’re here to answer all your questions and lend you a helping hand.